VinFast, Vietnam’s Electric Vehicle Manufacturer, Goes Public on Nasdaq Amid Investor Concerns of a Bubble

VinFast Auto, a prominent electric vehicle manufacturer from Vietnam, has successfully concluded its merger with the special purpose company Black Spade Acquisition Co (NYSE: BSAQ) and has debuted on the NASDAQ stock exchange in the United States.

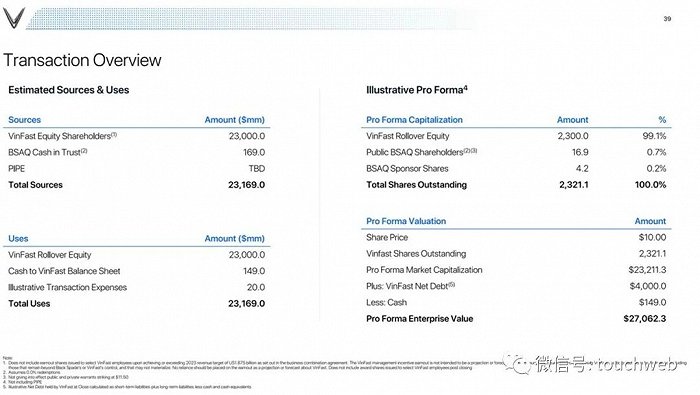

This strategic merger has positioned VinFast with an approximate valuation of $27 billion, boasting an equity value of roughly $23 billion. This valuation does not include approximately $169 million of trust cash from BSAQ, unless there is a decision from Black Spade shareholders to redeem their shares as allowed under the circumstances.

On its first trading day, VinFast began at a price of $22, surging to a closing price of $37.06, marking an impressive 254.64% increase from the initial issue price. This remarkable performance equates to a market capitalization of $86 billion for VinFast.

Earning the distinction of becoming the largest publicly listed Vietnamese company in the US, VinFast also claims the title of the biggest listing in the US market thus far in 2023.

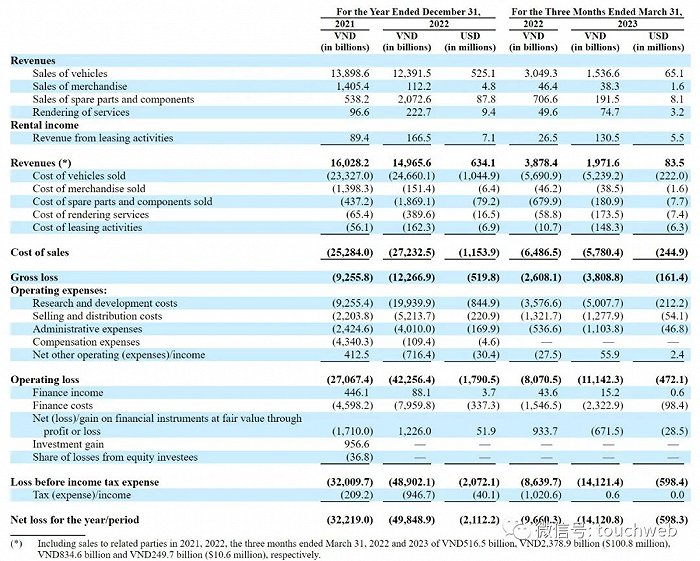

Nonetheless, VinFast’s revenue and delivery figures fall significantly short of China’s new automotive entrants – Weilai, Xiaopeng Motors, and Li Auto. As a result, some investors are expressing concerns over a potential market bubble.

VinFast’s IPO journey has seen its fair share of challenges. Despite attempting a conventional Initial Public Offering, the market response was underwhelming, mirroring the predicament faced by other companies like Lordstown, Nikola, and Faraday Future, which witnessed substantial declines in market value post their SPAC mergers and listings.

In the same vein, while Rivian initially achieved a market value exceeding $150 billion upon listing, it now commands a valuation of less than $20 billion.

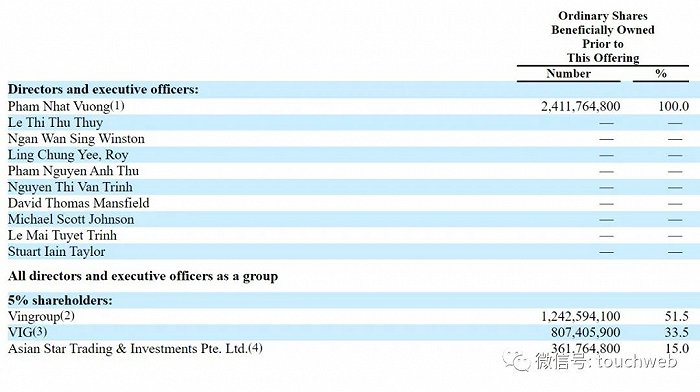

Originating under the umbrella of Vingroup in 2017, VinFast has ventured into producing and exporting a range of vehicles, including SUVs, electric scooters, and electric buses across Vietnam, North America, and soon, Europe.

In a bid to amplify its electric vehicle portfolio, VinFast transitioned into a pure electric vehicle manufacturer in 2022. The company has already introduced four electric vehicle models to the Vietnamese market: VF e34, VF 8, VF 9, and VF 5. It’s anticipated that the initial batch of VF 8 electric vehicles will be exported to North America in early 2023.

Recently, VinFast commenced construction on a facility in North Carolina, USA, projected for completion in July 2024 and operational commencement in 2025. The initial phase of the plant is expected to have an annual production capacity of 150,000 vehicles.

Despite some hurdles in its path to going public, VinFast’s debut on NASDAQ demonstrates its persistence in carving a niche in the electric vehicle landscape. As Vietnam’s premier electric vehicle player, VinFast’s journey is closely watched by investors and industry players alike.

Auto in China

Auto in China