Tesla продолжает стимулировать рост рынка электромобилей в США в первом полугодии 2023

В динамично развивающихся США. Рыночный ландшафт характеризуется оживлением поставок чипов и возобновлением производства бензиновых автомобилей, Электромобилей (Электромобили) наблюдают временное замедление темпов опережения других типов транспортных средств.

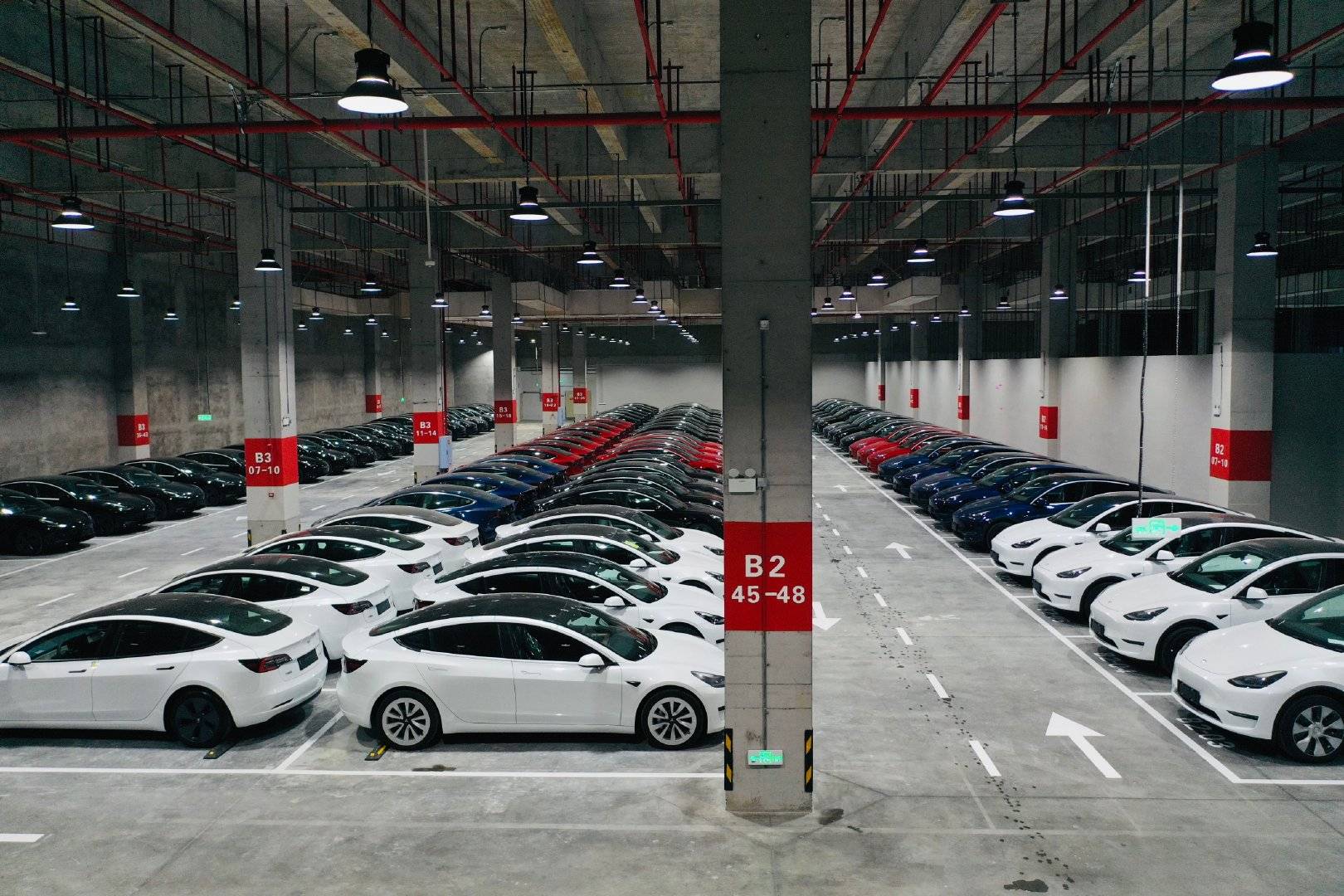

(Образ: Модель Тесла 3)

Examining the US EV market in the initial half of the year, a perceptible moderation in market share expansion is evident. Experian’s recent release of U.S. EV registration data reveals that January saw 87,708 electric vehicle registrations, accounting for a 7.1% market share—a figure consistent with the overall market share. Сравнительно, EVs constituted 5.6% и 3.1% of the U.S. new car market in 2022 и 2021, соответственно.

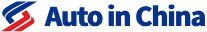

Intriguingly, data underscores Тесла‘s commanding influence within the U.S. Рынок электромобилей. During H1 2023, Tesla registered 329,608 vehicles in the United States, reflecting a robust year-on-year growth of 44%. This impressive performance enabled Tesla to maintain a 60.3% Доля рынка, effectively spearheading the growth trajectory of the U.S. Рынок электромобилей. Sequentially, Tesla’s U.S. registrations surged from 155,360 to 174,248—a noteworthy 12% quarter-on-quarter increase.

Tesla’s Модель Y и Модель 3 have solidified the brand’s foothold, with these two models collectively occupying the top slots in U.S. EV registrations. An upsurge in Model Y registrations, nearly doubling from H1 2022, и 12% increase in Model 3 registrations, further cement Tesla’s dominance.

(Образ: Tesla Garage)

While EVs have historically fueled growth in the U.S. new car market, it’s evident that the pace of expansion has stabilized in H1 2023 after consistent growth in 2021 и 2022. Observers suggest this moderation signals a shift towards targeting a broader consumer demographic, necessitating strategies that address existing vehicle pricing and charging infrastructure limitations.

Jessica Caldwell, Executive Director of Insight at Edmunds, notes that while initial consumer enthusiasm has been substantial, broadening EV adoption requires addressing price barriers and infrastructure gaps that deter mainstream consumers.

Заглядывая в будущее, США. EV market faces challenges stemming from increased EV inventory and rising sales incentives, potentially pressuring manufacturers. США. EV inventories exceed market averages, with a 103-day supply according to Cox Automotive. Sales incentives for EVs average around $4,000—double the amount offered for gasoline vehicles.

Industry analysts suggest that with increasing competition, automakers are faced with excess EV inventory due to insufficient demand. Карл Брауэр, Executive Analyst at iSeeCars, highlights that even with price cuts and lucrative incentives, the average consumer remains hesitant to purchase electric cars, challenging the narrative of rapid growth.

Amid these challenges, Tesla—the market leader—is not immune to market pressures. Despite price reductions and incentives, Tesla’s once-vigorous growth has steadied. Tesla CEO Elon Musk’s commitment to price reductions reflects the company’s strategy to achieve its ambitious 2023 Цель продаж 1.8 млн автомобилей.

(Образ: Lucid)

Cox Automotive identifies a silver lining: the average transaction price of U.S. EVs has dropped from $61,000 в январе, attributed partly to Tesla’s pricing adjustments. Nonetheless, in the short term, electric cars remain pricier than gasoline counterparts, deterring some buyers.

To overcome these hurdles, expansion of budget-friendly EV options is crucial. Despite anticipated moderations in the pace of EV sales, the industry’s trajectory remains a tale of transformation, driven by evolving consumer preferences and a commitment to sustainable mobility.

Авто в Китае

Авто в Китае