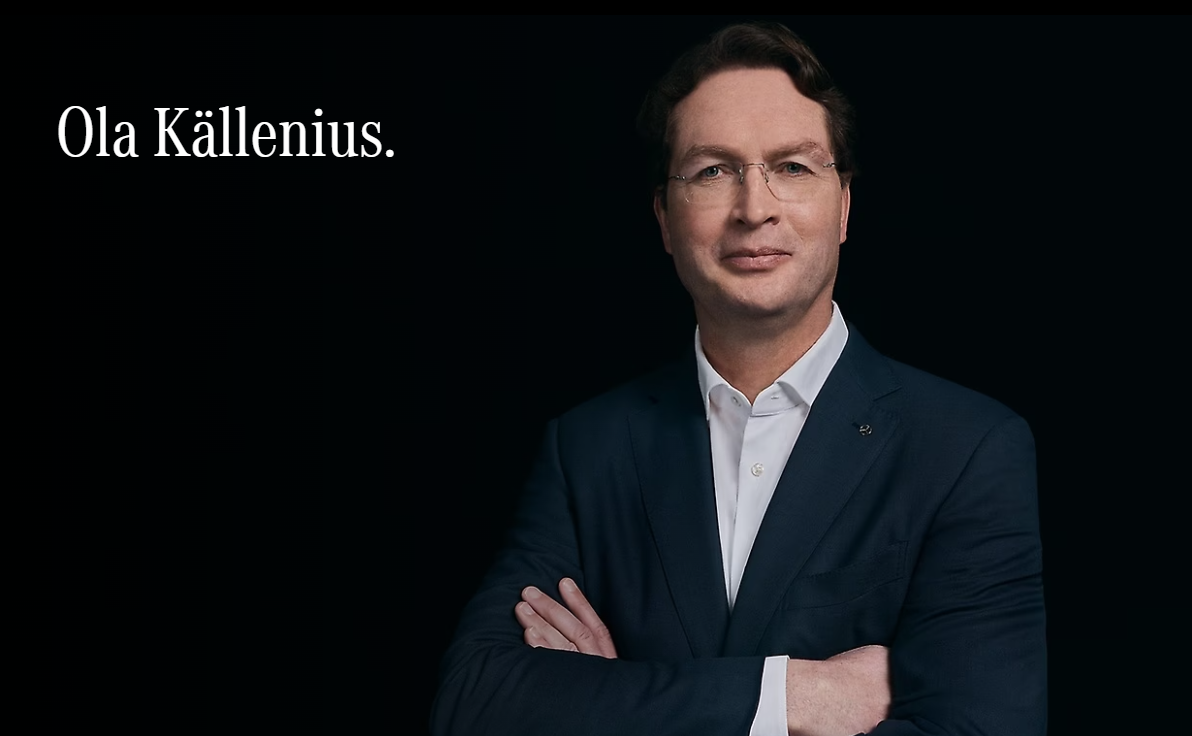

Mercedes-Benz Chief Executive Officer Discusses Strategy: Emphasizing Price Stability and Brand Value over Price Battles

In the early months of this year, Elon Musk, the CEO of Tesla, openly acknowledged, “I believe there is a substantial number of individuals interested in purchasing Tesla vehicles, yet find them financially out of reach.”

(Image: Mercedes Benz)

At that juncture, Tesla ignited a global frenzy of price competitions, surprising industry contenders like Ford Motor and General Motors.

The abrupt and aggressive price reductions from Tesla took the industry off guard, possibly aimed at pressuring competitors out of the market. Antoine Weill, a partner at Simon-Kucher & Partners consultancy, commented during an interview at the time, “Tesla’s rapid and drastic price cuts exceeded expectations. Their intention might be to force rivals to retreat.”

In response to Tesla’s swift price adjustments, companies such as Ford Motor and Lucid mirrored Tesla’s price slashes to sustain competitiveness. In contrast, Volkswagen Group, General Motors, and other entities in the automotive sector opted not to engage in this aggressive pricing war.

Mercedes-Benz, in particular, affirmed its stance against participating in this price warfare.

“Mercedes-Benz Chooses Price Stability over Following Tesla’s Lead”

Ola Källenius, the CEO of Mercedes-Benz, conveyed, “Maintaining equilibrium between supply and demand is crucial in any market. However, for a distinguished brand like Mercedes-Benz, radical strategies are often counterproductive.”

Mercedes-Benz is actively transitioning towards electric vehicle technology, committing to the “Ambition 2039” initiative for carbon neutrality. While introducing new all-electric models like EQE and EQS, the company also incorporates hybrid iterations of conventional models such as the latest E-Class. Conlinsong stated firmly, “Our objective is unambiguous – our vehicles must be emissions-free, without exceptions.”

Nevertheless, the existing global economic conditions present hurdles to this transformation. The surge in inflation within major economies worldwide, along with subsequent interest rate hikes, has generated a state of “macroeconomic cooling.”

Amidst this economic cooling, Mercedes-Benz’s transformation comes with substantial costs. Conlinsong highlighted, “We are investing billions, potentially tens of billions, in this endeavor – not solely in electrification but also in other shifts within the automotive industry.”

Venturing into emerging economies with novel products could recuperate portions of this investment, though immediate gains pose challenges. China, a pivotal market, was anticipated to rebound swiftly post the pandemic, as many experts and analysts projected. However, Kang Linsong noted that the present market situation remains somewhat sluggish.

“As an automaker, determining the appropriate response within this context is imperative.” For Mercedes, maintaining price stability stands as a priority. “We prioritize crafting enduring vehicles with retained value and longevity.”

To uphold price stability, Mercedes must display flexibility in other realms. The company’s capability to meet market demands while producing both internal combustion and electric vehicles on the same assembly line is pivotal. Conlinsong elaborated, “Our extensive facilities in the Southeast and Alabama enable us to manufacture two models simultaneously. This flexibility empowers us to align with market trends across Germany, China, and other global markets.” He added, “Our flexibility in production aligns with our anticipation of an electrified future.”

Consequently, Mercedes-Benz has decided against altering suggested retail prices according to market fluctuations, distinguishing itself from Tesla’s approach.

“Mercedes-Benz Adopts Tesla’s Charging Technology for Long-Term Gains”

Interestingly, Mercedes has taken inspiration from Tesla in another domain – the North American Charging Standard (NACS). In July of this year, Mercedes-Benz announced its adoption of Tesla’s NACS charging standard, supplanting the prevalent CCS standard within the North American market.

While concerns surfaced about short-term market disruptions and impacts on customer charging experiences, Kang Linsong confidently allayed those fears, stating, “We remain committed to catering to our customers under all circumstances.”

Furthermore, Mercedes approached the decision to embrace Tesla’s charging standard with due diligence.

Historically proprietary, Tesla’s charging standard now opens up due to the United States’ dedication to accelerating electric vehicle adoption. Given Tesla’s position as a leader in the EV realm, its charging network boasts substantial penetration and ranks as North America’s largest. Tesla Superchargers reportedly account for around 60% of the nation’s fast charging infrastructure, as per the U.S. Department of Energy.

Hence, Mercedes-Benz joined several traditional and electric car manufacturers, including Ford Motor, General Motors, Volvo Cars, Polestar, Nissan Motor, Rivian, and Fisker, in collaborating on charging solutions with Tesla.

Kang Linsong candidly asserted, “From a Mercedes-Benz standpoint, which charging plug is best poised to become the prevailing standard in the North American market? Following meticulous analysis, we concluded that, in the medium to long term, NACS is the answer, not CCS.”

Yet, he clarified that, at least in the immediate future, CCS and NACS will coexist in the North American charging landscape. Mercedes commits to supporting both technologies in its forthcoming luxury charging network, each station equipped with dual cables to eliminate the need for adapters.

“This approach reassures our customers, offering them certainty. That’s our driving force behind this decision,” Kang affirmed.

Auto in China

Auto in China