Rapport d’analyse des données du marché des voitures importées de la Chine

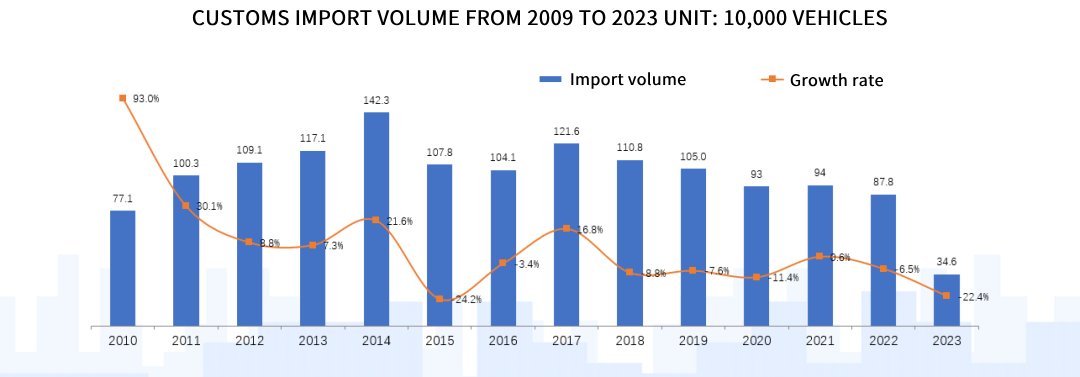

Customs import volume:

(1) Supply: After three years of decline, automobile imports will decline slightly in 2022 and accelerate in 2023, entering the period of “destocking”.

From January to June, 346,000 vehicles were imported, a decrease of 22.4%; the import value reached 150.07 milliards de yuans, a year-on-year decrease of 17.5%. En juin, 63,000 vehicles were imported,

An increase of 8.6% d’une année sur l’autre.

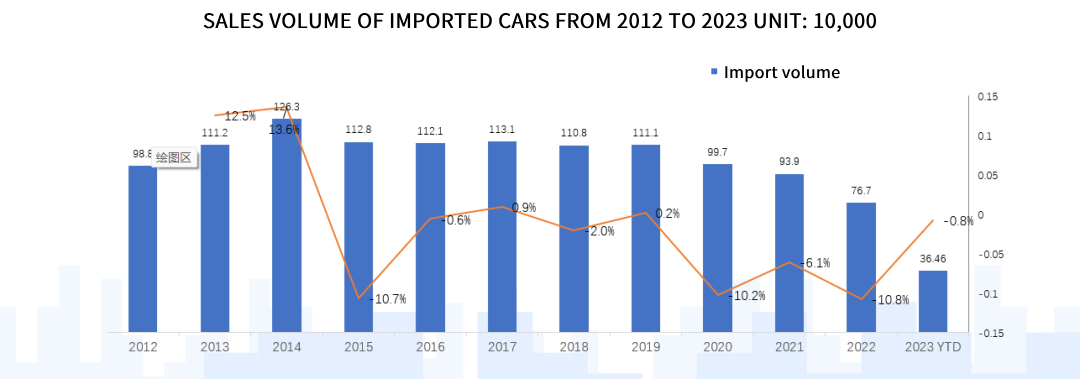

Imported car sales:

(2) Demand: Au cours des dernières années, the terminal demand for imported cars has remained relatively stable.

The imported car market has declined, with a cumulative sales of 364,600 vehicles from January to June 2023, a slight decrease of 0.8% d’une année sur l’autre.

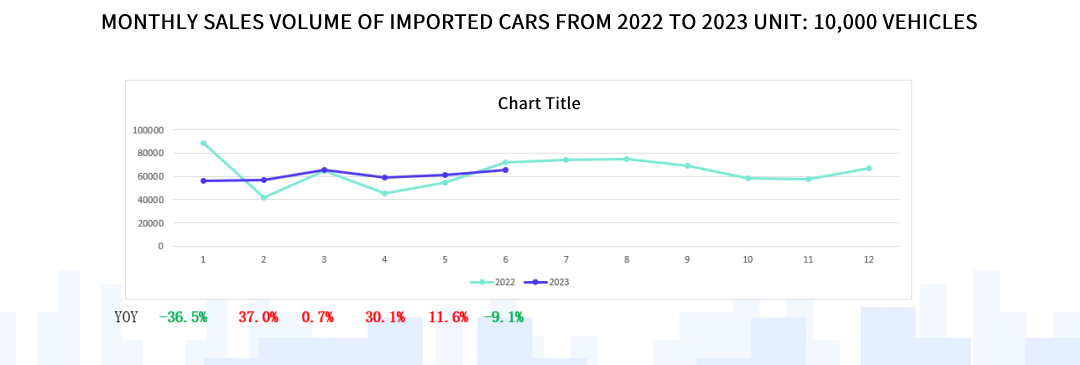

(2) Demand: Judging from the monthly sales trend of imported cars from 2022 À 2023, the market shows signs of recovery, with sales from February to April averaging

Achieved growth, the high growth in February was due to the Spring Festival factor, the high growth in April and May was due to the low base last year, and June was affected by the high base last year

There is a decline.

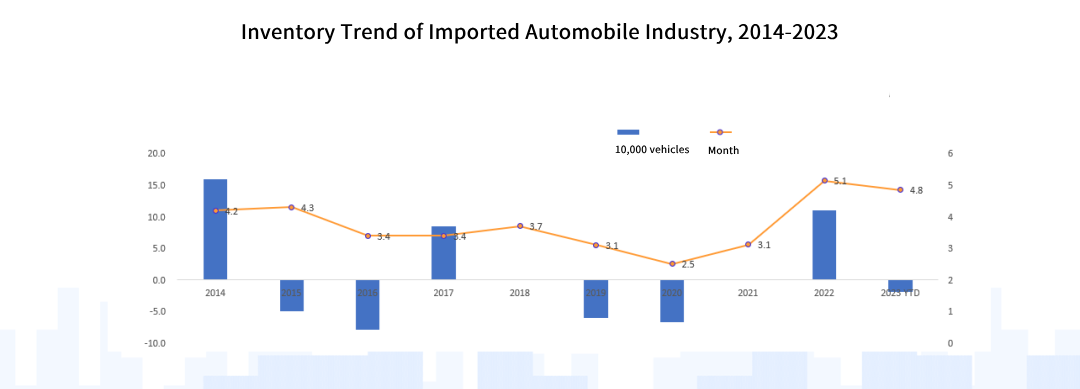

En stock

(3) Inventory: The beginning of 2023 will enter the destocking cycle as expected, the supply of imported cars from January to June will be less than the demand, and the absolute amount of inventory will decrease

Compared with the end of 2022, the inventory depth has dropped slightly to 4.8 Mois, which is still at a high level.

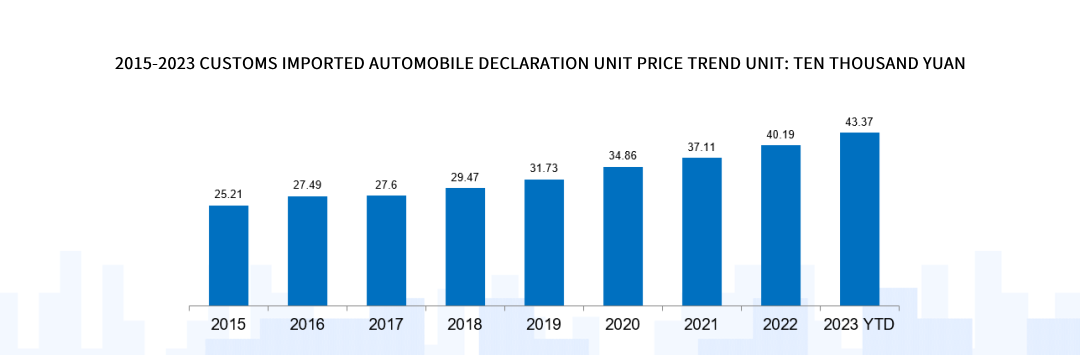

Customs Price

(4) Prix: The unit price of imported automobiles has increased year by year. From 2015 À 2023, the unit price of imported automobiles will increase from 252,100 yuan.

The rise to 433,700 yuan is due to the trend of consumption upgrading, the trend of localization of low-priced products, and the recent depreciation of the exchange rate.

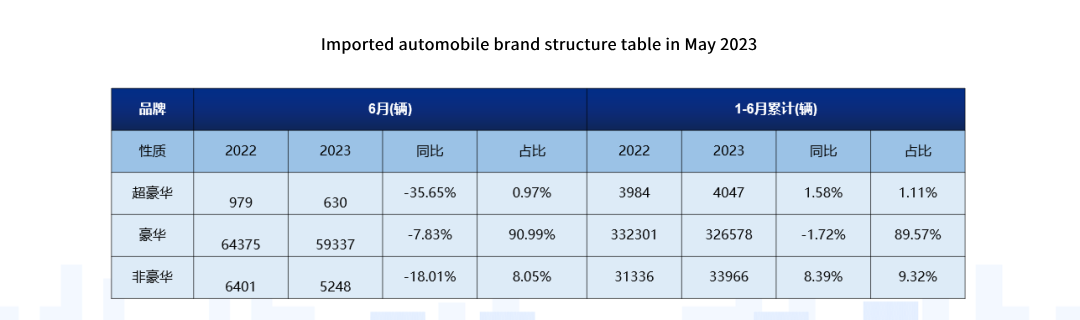

Brand Structure

(5) Brand structure: The overall imported car market showed signs of weakness this month, and sales of ultra-luxury cars fell by 35.65% year-on-year this month.

From January to June, the cumulative year-on-year increase rose slightly by 1.58%. Sales of non-luxury cars also fell 18.01% year-on-year for the month. Luxury cars are still the main sales force, 6

Monthly sales fell by 7.83% d’une année sur l’autre, and the cumulative proportion from January to June was 89.57%.

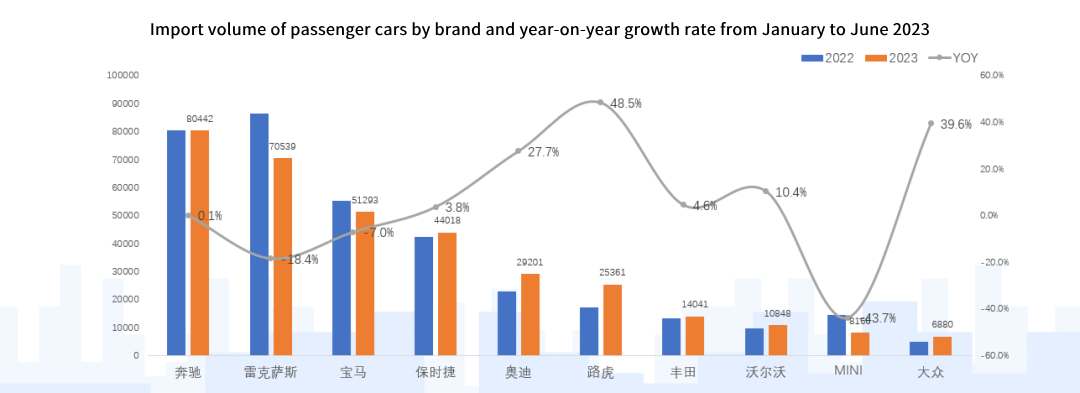

(6)Brand distribution: From January to June 2023, seven of the top ten brands (Mercedes-Benz, Porsche, Audi, Land Rover, Toyota, Volvo, Volkswagen) all

It is growing now; Mercedes-Benz, which ranks first, sold 80,442 Unités, une augmentation de 0.1% d’une année sur l’autre, and the sales of BMW and MINI fell due to domestic models.

Sliding 7% et 43.7%, the weak sales of the main model ES series dragged Lexus down 18.4%.

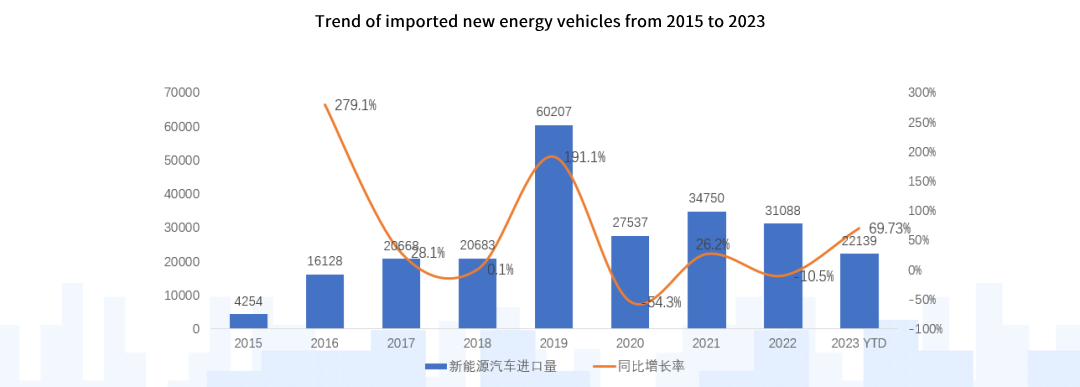

(7) Fluctuations in sales of imported Véhicules à énergie nouvelle: From January to June 2023, sales of new energy vehicles reached 16,725 Unités, une augmentation d’une année sur l’autre de 69.73%. plug-in hybrid and pure

Both electric vehicles maintained a rapid growth trend, with year-on-year growth of 25% et 151% respectivement. Porsche Cayenne among plug-in hybrids needs Texas RX and Volvo

Volvo XC90 has a large increase: among pure electric models, Porsche Tavcan, Tesla ModelX, BMW i-series and Lexus RZ have contributed the most to the increase.

Auto en Chine

Auto en Chine